A Beginner’s Guide to ESG Investing

Oftentimes, our monetary resources serve as a vehicle for us to share our values and beliefs with the world around us. You are likely familiar with the concept of “voting with your dollars” which can refer to anything from supporting small local businesses to only buying clothes that move through an ethical supply chain. While these actions certainly have the greater good in mind, there are also many other ways you can make a difference.

Putting your investment dollars to work for a cause you care about, a concept called ESG (Environmental, Social, & Governance) investing is one such option. Building an ethical, ESG-based portfolio allows you to support your specific values and have your investments mirror your purpose. If you are interested in learning more about how you can make a difference, our investment advisors in Charleston, SC, are going to give you a breakdown of what this investment strategy is and how you can start building a more sustainable portfolio today.

A Guide to Economic, Social, and Governance Investing

What Is ESG Investing?

The definition of environmental, social, and corporate governance, abbreviated ESG, investing is continually evolving. You may be familiar with the terms socially responsible investing (SRI), ethical investing, sustainable investing, impact investing, and values-based investing. All of these are often used interchangeably in related contexts. Yet, these investments differ in that they are more generic and can have varying approaches when it comes to portfolio creation. While these strategies can use an ESG-based grading system to judge an investment, traditionally, they take a subjective exclusionary-only approach. For example, ethical investing strategies may only eliminate companies from the portfolio that the investor deems “immoral” based on their values, such as those that sell products made in factories with inhumane and unethical working conditions. Or, maybe it’s a company that sells tobacco products or alcoholic beverages.

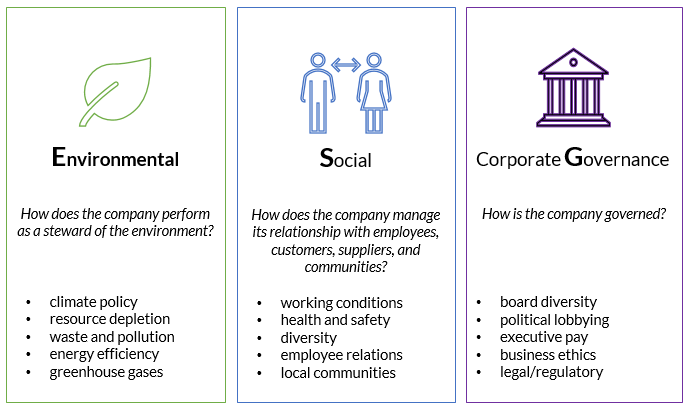

In contrast, an ESG-based investment strategy might eliminate such companies while also including companies that create a positive impact. ESG investing involves creating a more ethical and sustainable investment portfolio based on three specific categories: environmental considerations, social impact, and corporate management. Each of these three aspects is evaluated to calculate an ESG score for the investment. So, who makes these determinations? There are many professional rating services that measure the ESG potential within companies. To better understand what these companies look at when determining an investment’s score, here is a breakdown of each category:

How Does ESG-Based Investing Work?

If you are actively engaging in ESG investing, your investment strategy may select and prioritize companies that screen higher for your concerns and exclude those that score poorly. This ESG focus allows investors to capture broad capital market returns while also considering the impact on the environment, people, and communities. You still have choices within ESG investing. For example, an ESG integration strategy takes ESG issues into account while maintaining financial factors as the primary focus. Impact investing is another branch of ESG investing where ESG issues are used to maximize societal reach and make a quantifiable difference. In essence, the main facet of ESG-based investing strategies is consciously balancing sustainability and profitability based on individual preferences and priorities. That way, you get the most bang for your buck.

Why Should I Care About ESG-Based Investing?

The end goal of this process is to create a lucrative portfolio that continues your ability to make meaningful decisions and to contribute to the greater good. ESG strategies seek to deliver attractive financial returns while also considering the overall impact of the investment and other non-financial issues. These metrics allow you to have an impact in accordance with your values, without sacrificing the reason for investing in the first place: to get your money to work for you. Aside from the benefits of being more intentional and meaningful, ESG investments have also shown to be profitable over the last decade when compared to other industry benchmarks. 1

There is increasingly widespread recognition that ESG strategies can contribute to humanity’s collective wellbeing in concrete ways. We are seeing many companies take environmental and social challenges more seriously, along with management initiatives for more inclusion and diversity on their boards. ESG investment platforms can also help encourage management to embrace demands for greater transparency and accountability for all stakeholders. In turn, better data and information continue to increase ESG investment availability.

ESG Investing With Our Charleston Investment Advisors

Your financial journey is a personal one. There is not a one-size-fits-all solution. Building an investment portfolio takes time, especially when you are trying to align it with your individual framework of values and goals. Although Morris Financial Concepts has offered sustainability and socially conscious concepts to our global clientele base for many years, ESG-based investing is becoming more mainstream in the finance world. If you are interested in creating an ESG fund and aren’t sure where to start, we can help!

Our team of investment advisors in Charleston, SC, continues to work diligently to understand the challenges and opportunities presented by the rapidly changing ESG investment landscape. We are exploring opportunities ranging from additional passive ESG strategies to customizable issue-based approaches. If you wish to align investments more directly with your values, it is now easier to accomplish. Through our tailored financial planning process, we take the time to understand what makes you “you” so that we can create a custom fund that reflects your goals and values.

ESG investing is yet another tool we can use to help you achieve your financial goals, meaning, and fulfillment – to put your money where your heart is. Reach out to the Morris Financial Concepts’ investment advisors in Charleston, SC, to learn how we can help you get started today!

About the Author

Bart Valley is a Charleston investment advisor and Chartered Financial Analyst® at Morris Financial Concepts in Mt. Pleasant, SC, with over 16 years of experience in investment counseling and consulting experience. Bart primarily focuses on providing detailed investment counsel, education, and guidance that aligns with holistic financial goals and life aspirations. Bart works collaboratively to clarify individual wants and needs. He provides a risk assessment to establish and implement comprehensive, tailored investment plans for our Morris Financial clients.

Bart Valley is a Charleston investment advisor and Chartered Financial Analyst® at Morris Financial Concepts in Mt. Pleasant, SC, with over 16 years of experience in investment counseling and consulting experience. Bart primarily focuses on providing detailed investment counsel, education, and guidance that aligns with holistic financial goals and life aspirations. Bart works collaboratively to clarify individual wants and needs. He provides a risk assessment to establish and implement comprehensive, tailored investment plans for our Morris Financial clients.

1. Source: Morningstar, Inc.

Indices: Morgan Stanley Capital International (MSCI), Standard & Poor’s/S&P Global

10-Year Annualized Return as of 3/23/2021

World All-Cap:

MSCI ACWI Index +9.89%

MSCI ESG Leaders Index +10.35%

U.S. Large Cap:

S&P 500 Composite Index +13.98%

S&P ESG Index +14.29%

The opinions expressed herein are those of Morris Financial Concepts, Inc. (“MFC”) and are subject to change without notice. Nothing contained herein is intended to be investment advice. Nothing contained herein is an offer to buy or sell a particular security or investment strategy. Past performance should not be used as an indicator of future results. The Chartered Financial Analyst (CFA) is a qualification for finance and investment professionals, particularly in the fields of investment management and financial analysis of securities. The designation is an international professional certification offered by the CFA Institute to financial analysts who complete a series of examinations. The CFA designation is awarded to candidates who must pass each of three six-hour exams, possess a bachelor’s degree from an accredited institution, and have four years of qualified professional work experience. CFA charter holders are also obligated to adhere to a strict Code of Ethics and Standards governing their professional conduct. CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute. Please refer to www.cfainstitute.org for further information. MFC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about MFC including our investment strategies, fees, and objectives can be found in our ADV Part 2, which is available upon request. MFC-21-07.