Five Rules to Improve Your Financial Health

Personal financial goals are all too important when planning for a healthy and happy future, but can certainly be stressful to dive into. The key to financial health goes beyond the age-old “rules of thumb” that your grandparents have diligently lived by. These five rules to improve your financial health give some more concrete advice to get you back on track with achieving your financial goals.

1. Understand Needs vs. Wants

Proper spending choices are a critical backbone of making healthy financial decisions. It’s great to treat yourself to a happy hour cocktail or takeout dinner from time to time, but if you find yourself spending money on non-essentials far too often, it may be time to re-evaluate your spending choices.

Sometimes it can be challenging to distinguish between the two. Needs include food, shelter, clothing, and healthcare; all of which a savings account can be useful for. Putting aside 10% of your income, or an amount that is reasonable for you can be helpful. But what happens when needs can also be classified as wants? For example, clothing is essential but the choice between practical, inexpensive clothing and luxury, designer clothing comes at two very different costs.

In general, our rule is this: the absolute essentials should come first in your personal budget. Once that is handled, calculate how much leftover income you have and understand it all doesn’t have to go towards your wants. It’s good to reward yourself for hard work, but it is also crucial to save extra income as well. Balancing both is key when maintaining a healthy personal budget.

2. Create a Plan for Emergencies

Emergencies and accidents are bound to happen along your financial journey. It’s important to understand and react to this accordingly. Don’t be devastated if you have to draw more out of your savings than you had budgeted because of an emergency.

The typical suggestion is to have 6 months of income set aside for emergencies. It’s standard for this savings net to cover things like car repairs, necessary home renovations, and sickness. Events like these are things we have to prepare for financially. Our reactions to them after they occur are equally important.

Before emergencies happen, keep yourself accountable and set benchmarks to establish a proper savings fund. There are some great monitoring software systems to help you stay on track, including mVelopes and YNAB. A financial planner can also help you define savings goals that are attainable, and sustainable for your lifestyle.

3. Start Saving Early

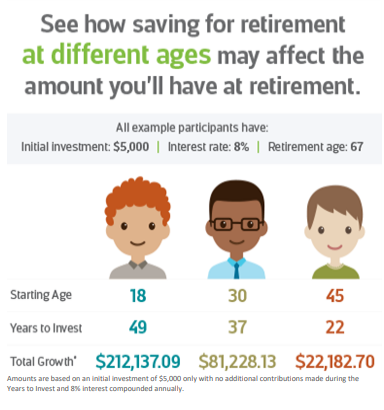

Early contributions to retirement funds and savings accounts make all the difference.

Thanks to compounding interest, your savings will make you money over time just by sitting in your account. When you contribute early, you set yourself up for exponential gains.

A normal savings account generates interest on your principal amount saved. An account with compounding interest still gives you interest on that principal amount, but it also generates interest on the interest you’ve earned. Starting to save early gives your retirement account more valuable time to capitalize on the snowball-like effect of compound interest. The above infographic illustrates just how vital time is for retirement savings growth.

A normal savings account generates interest on your principal amount saved. An account with compounding interest still gives you interest on that principal amount, but it also generates interest on the interest you’ve earned. Starting to save early gives your retirement account more valuable time to capitalize on the snowball-like effect of compound interest. The above infographic illustrates just how vital time is for retirement savings growth.

Even if you simply set aside a minimum amount when you’re younger, you can increase your retirement contributions saved as you age. Every incremental increase makes a difference, and you are less likely to be scrambling to increase your savings as you get older since you already established an account early on.

The sooner you start planning for retirement, the easier it will be to enjoy yourself once the time comes around.

4. Plan for Lifestyle Inflation

Typically, the older you get, the more money you will be making. The more money you start making, the more money you start to spend. Lifestyle inflation takes hold in this directly corresponding relationship; as people advance in careers and start earning more money, they spend more too. If lifestyle inflation is handled responsibly, there are also more opportunities to save.

Lifestyle inflation is not bad, but when you inflate spending habits it’s important to inflate your other financial goals as well. Don’t just spend more. Use lifestyle inflation to contribute greater amounts to your retirement and savings goals. Build up your emergency fund. Keep lifestyle inflation in check by staying on top of your responsible financial goals. You may enlist the help of a certified financial planner to help you do so!

5. Do Some Personal Calculations

Setting some time aside to do some personal calculations can be very beneficial when dealing with personal finances. It’s not as tricky as people may think, and it gives you a better understanding of your income and goals when planning for your future.

Your net worth is the most valuable calculation. Writing down your assets and comparing them to your liabilities can give you an accurate representation of your net worth. Start by listing out all your assets (what you own) and all your liabilities (what you owe), and subtract the liabilities from your assets to figure out what is left. It’s a good indicator of your financial standpoint at the moment.

Calculating net worth on a yearly basis is recommended since this number is bound to fluctuate year to year. It’s a great measure to track the progress of your finances, highlight successes, and develop plans for areas that need improvement.

Personal financial discussions can be overwhelming and uncomfortable if you are unsure of where to begin. It isn’t easy to dedicate time to take a look over your spending, or to break unhealthy financial habits. If you would like a better plan implemented to help adjust your spending measures and evaluate the health of your personal financial goals, our financial advisors at Morris Financial Concepts can help! Contact one of our Charleston financial advisors with any additional questions or concerns you may have about improving your financial health and sticking to your wealth management.

The opinions expressed herein are those of Morris Financial Concepts, Inc. (“MFC”) and are subject to change without notice. This material is for informational purposes only and should not be considered investment advice. Nothing contained herein is an offer to buy or sell a particular security. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future results. Historical returns, market conditions based on historical events, and probability projections are provided for informational and illustrative purposes and may not reflect actual future performance. MFC relies on information from various sources believed to be reliable, including third parties, but cannot guarantee the accuracy and completeness of any third-party information. MFC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about MFC including our investment strategies, fees, and objectives can be found in our ADV Part 2, which is available upon request.