The October Effect

What is going on in the markets? The 3rd quarter of 2018 ended as the best quarter on the S&P 500 since 2013 – around a 7.2% increase. From September 30 through October 26, the S&P lost around 8.6%, the worst beginning of a quarter since 2008. Is this the October effect, or is there something substantial going on? What are the realities?

It’s difficult to come up with convincing fundamental explanations for this poor performance. As expected, the Feds did increase interest rates at the end of September. Investors can also purchase U.S. Treasuries yielding 3%. This increase in yields is driven primarily by rising real yields that tend to reflect rising growth expectations. Economic growth should more likely be a positive, rather than a negative factor for market sentiment.

Earnings are good overall, and valuations have come down because earnings have outpaced stock prices. Trade tariffs have had an impact on some sectors, but their impact on the overall economic growth and inflation is modest at best. Fiscal stimulus should still provide support for businesses. The job market is tight with more jobs available than workers to fill them. Inflation remains in check and is not yet an issue. New orders and production for manufacturing has been mixed but overall holding a steady, moderate pace. With so many US averages breaking out with new all-time highs, the sign of an unhealthy market does not seem warranted.

At least until recently within the US equity markets, investors were not all that worried about the fundamentals.

Could this latest weakness be simply another temporary panic attack? This is normal. The markets get nervous, and historically the S&P experiences a 5% decline about every 2 months on average. Have the markets forgotten how to deal with volatility? In 2017 there was not one 5% decline, and in 2018 the time lag between panic attacks was longer than usual. The last stock market setback was February this year.

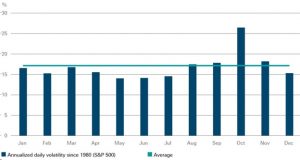

Seasonality statistics tell us that October should actually be a good month for stocks. But there’s another way of looking at seasonality. The chart below from Bloomberg Finance L.P. indicates that October is the most susceptible month to panic attacks. It is also typically accompanied by unusually high levels of stock-market volatility. The data taken from 1980 through October 18, 2018, shows that the average realized volatility tended to be fairly balanced for all calendar months. Only October stands out as the big exception.

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 10/18/18

October with the Great Depression, October with the crash in 1987, and October in 2008 all represent the market jitters that manifests itself in October. There is still the question – Why October? Unfortunately, there are not really any strong theoretical reasons to explain it. The study of calendar effects for a cause does not yield any answer except for a self-fulfilling phenomenon.

What’s next?

We believe there are some major macroeconomic factors that will be influential on investors over the next 6 to 12 months: trade policy, interest rates & Federal Reserve (Fed) policy, earnings growth, global economic growth, and the U.S. dollar.

- Trade Policy

- Robert Bush, an economic strategist with DWS, said, “…tariffs, in general, can be thought of as throwing sand in the cogs of the usually well-oiled global trade machine.” Protectionism can damage the efficiencies of specialization and comparative advantage and erode economic gains overall.

- Federal Policy

- The Federal Policy is close to neutral. This may change in 2019 and 2020 as the economy is monitored Rates may rise beyond the neutral level hopefully to keep overall economic alignment.

- GDP Growth

- GDP growth is expected to remain moderately strong for the next 6 to 12 months, although somewhat slower reflecting the tight job market and the fading impact of fiscal stimulus.

- The Dollar

- The value of the US dollar is high currently. With some of the global uncertainties, there is a flight to safety into US Treasuries and the dollar.

From all I’ve read and studied to get a feel for what’s happening this October, I am not sensing that we are about to go over a cliff. In my opinion, total doom and gloom are not apparent. There are issues to watch, and the economy will slow. Economic cycles will likely continue. If you are clients of MFC, we are positioning your portfolios to be able to ride through them. Speaking with your financial advisor is always a good idea to have peace of mind they are doing the same. Do not try to time the markets. With all the underlying theories and causes identified, the realities are that the markets will likely continue to go up and down with a general upward slope over time.

Respectfully submitted,

Kyra Hollowell Morris, CFP®

Sources:

Raymond James – Investment Strategy Quarterly Vol 10 Issue 4 October 2018

DWS – October Strikes Again – https://dws.com/en-US/insights/cio-view/americas/chart-of-the-week-20181019/

US Economic Outlook – Joshua Feinman, Chief Global Economist DWS https://dws.com/US/EN/resources/insights/market-insights/US_Economic_Outlook_2018-10.pdf

Disclosure: The above links are to third-party sites and are not affiliated with Morris Financial Concepts, Inc (“MFC”). This article is for informational use only and should not be considered investment advice or an offer to sell any product. All opinions expressed are MFCs. MFC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about MFC including our investment strategies, fees and objectives can be found in our ADV Part 2, which is available upon request. MFC-18-11.